Sample Trade Plan

Semi-Auto Trading Triggers 1, 2 &/or 3

with HTF, Range, Linear Regression and

Momentum Trend Filters

Personal Profile.

Trade logic developer and third party vendor for NinjaTrader and Shark Indicators. I trade 15m/1hr momentum, trend, price patterns. I consider myself a trend follower and only take trades 'with' the trend.

Products Traded & Combine Profile.

I specifically trade the E-Mini NQ Futures contract, S&P 500 Futures Contract Russell Futures Contract, YM Futures Contract, Gold Futures contract, Nymex Crude Oil Futures contract and/or Euro Futures contract from 6:30AM to 10:30AM (cst) Monday to Friday. During the trade window, I will only take a trade that meets the trade model requirements. I will strive to take every legitimate setup that occurs during that trade window. Considering the market's pickup in inherent volatility, these are very high risk products to be traded with a self-imposed maximum daily loss limit. At the same time, I believe it is a very good structure for trading futures.

Daily risk & reward expectations.

I can risk a maximum of $600 on any given day and can make a maximum of $1,800. I only take trades that are entered on an OCO basis (-30/+30 or +60). An Ideal trading day would consist of two or three successful trades.

Economic Indicators.

I will use the Economic Calendar to determine optimal trading times around economic events, timing trading opportunities with economic indicators that tend to move the markets.

Directional Pattern.

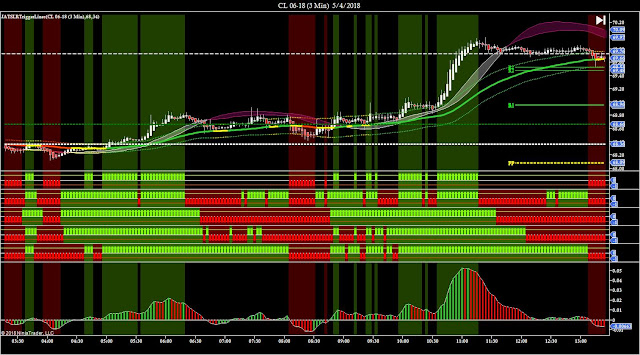

I will use the customized NinjaTrader Market Analyzer with JATS BloodHound Templates and trade in the direction of momentum and trend on the 60, 15 and 3 Minute Charts.

Trading Model.

Wait for 1 hour trend to signal. Wait for 15 minute trend, and/or double top or double bottom price pattern that is in the same direction as the trend. Once 15 minute price pattern is in, move to a lower time frame chart (3 or 5 minute chart or 64 Tick UniRenko chart), and wait for momentum/volume/price confirmation of higher time trade trends. Once multiple time frame signals are confirmed, determine entry using either the JATSLRTBands, or JATSHiLo1 or JATSHiLo2 BloodHound Templates, and either use a 1:1 R/R target (32/32), or determine if there is another suitable target to trade to using Momentum, Fibs, Pivot Points, or Daily or 60 Minute support/resistance levels, and trade to 1:2 R/R target (30/60). Once filled, can move OCO stop to break-even only when +30 has been hit.

Possible scenarios that can play-out on any typical trading day (Trading 1 Contract):

1. 2 Losses = (2x-$300) = -$600

2. 1 Win, 1 Loss (OCO) = (1 x 30 = $300) - (1 x -30 = -$300) = $0

3. 1 Win, 2 Losses (OCO) = (1 x 30 = $300) - (2 x -30 = -$600) = -$300

4. 2 Wins (OCO) = (2 x 30) = $600

5. 2 Wins (Run to Target) = (2 x 60) = $1,200

6. 2 Wins (OCO), 1 Win (Run to Target) = (2 x 30 = $600) + (1 x 60 = $600) = $1,200

7. 3 Wins (OCO) = (3 x 30) = $900

8. 3 Wins (Run to Target) = (3 x 60) = $1,800

Track Performance Metric over 10 trading sessions

May double the contracts for NQ as it trades $5/tick

TRADING DISCLAIMER

We at J Auto Trading Strategies, LLC are not certified traders nor are we certified financial planners. We all chose this profession so that we could take our destiny into our own hands and aspire to a future of independence and satisfaction. We offer NO warranty whatsoever. Execution techniques differ from trader to trader. There is no way for us to predict any outcome of your trading.

We at J Auto Trading Strategies, LLC are not certified traders nor are we certified financial planners. We all chose this profession so that we could take our destiny into our own hands and aspire to a future of independence and satisfaction. We offer NO warranty whatsoever. Execution techniques differ from trader to trader. There is no way for us to predict any outcome of your trading.

RISK DISCLOSURE

Futures and forex trading have large potential rewards, but also contain substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones' financial security or life style. Don’t trade with money you can’t afford to lose. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading.

HYPOTHETICAL PERFORMANCE DISCLOSURE

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Copyright © 2018, J Auto Trading Strategies, LLC. All Rights Reserved. No part of this website may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except under the terms of the Copyright Designs and Patents Act 1988 or without express written permission of the author.

Copyright © 2018, J Auto Trading Strategies, LLC. All Rights Reserved. No part of this website may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except under the terms of the Copyright Designs and Patents Act 1988 or without express written permission of the author.